The Markets Are Underestimating the Russian Threat

Russia holds all the cards in their attempt to re-build the Soviet Empire

The markets are seemingly unfazed in their risk assessment about a potential Russian invasion of Ukraine. Oil is sitting at $72/bbl, up slightly, while gold, the market’s fear gauge is flat, at $1783/ troy oz. If the markets believe that a Russian invasion into Ukraine was likely, oil and gold would be much higher. The markets are severely underestimating that risk.

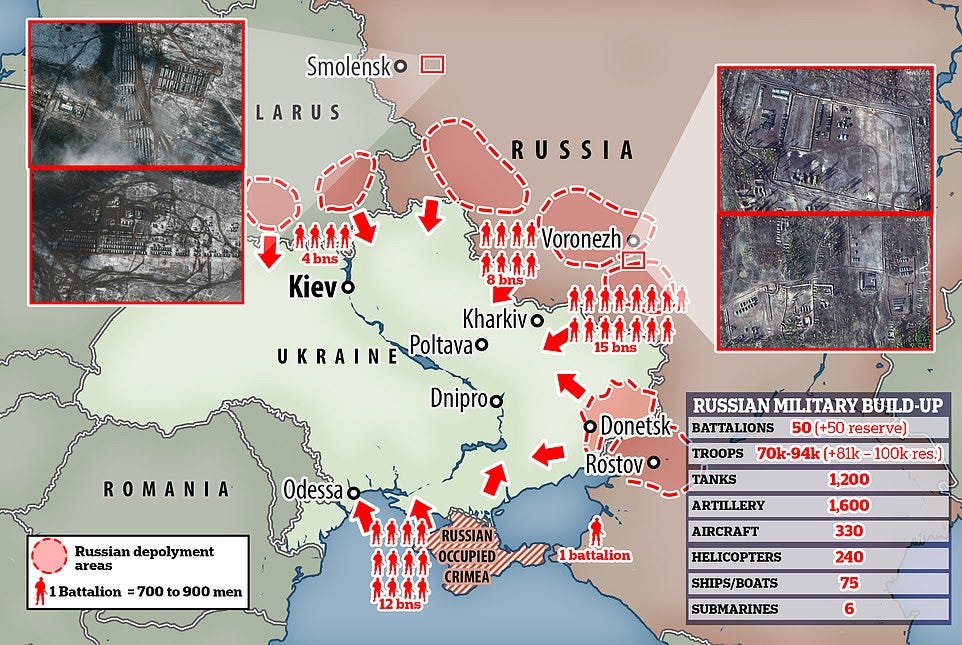

I believe there is a high likelihood that Russia will invade Ukraine within the next few months. U.S. intelligence officials agree with me. The main problem for the US is that the Russia “holds all the cards”. Meaning that the United States does not have either the political will nor the economic leverage to prevent Russia from invading Ukraine. President Biden spoke with Russian President Vladimir Putin yesterday and basically signaled that we will not proceed with military action against Russia. Biden warned Putin of “harsh economic sanctions” if Russia were to invade Ukraine, in addition to placing US troops in Eastern Europe. If you read between the lines, he is basically saying, “we will not use economic force against you.” Russia has been under continuous sanctions since the 2014 invasion of Crimea, as well as additional sanctions for “election meddling”. It is likely that any additional sanctions imposed by the US will not have a significant deterrent capability against Russian invasion.

Additionally, more than 30% of Europe’s natural gas comes through a pipeline directly controlled by Russia. With the snap of his fingers, Putin can cut off the natural gas supplies to all of Western Europe, creating a serious crisis as europeans would have severe difficulty heating their homes as the price of natural gas would rise significantly and it would be in short-supply. Europe understands this dire threat to their economy as a cold winter approaches.

Putin, wanting to restore Russia to its former “Soviet glory”, has every reason to invade Ukraine and to do so rapidly. Winter would create the perfect opportunity for Russia to invade as its tanks could easily drive over the frozen steppe into Ukraine, which is normally a muddy bog. Additionally, the world is in crisis attempting to recover from Covid and after twenty years of Middle Eastern war, the average American does not have the appetite for a war with Russia in order to save Ukraine.

As the threat continues to build for a Russian invasion of Ukraine, the second and third order effects on energy markets would be extreme. Oil would like go up 10-15% overnight on the news in addition to a large rally in defense contract companies such as Raytheon and Lockheed Martin. Gold would likely jump above $2000/ oz on a war of this magnitude. Equity markets would likely fall dramatically until traders could figure out the magnitude of a Russian invasion.

For further information on the potential Russian invasion of Ukraine, tune in to the Warren Letter Podcast live at 2:30pm Mountain/ 4:30pm EST. Today we will be hosting Mark Rossano, CEO of C6 Capital Holdings. Mark is a macro-economic and energy analyst who has been studying the Russia situation for years. He is a long-time Bloomberg contributor and will be providing his analysis on the potential invasion and how that will effect markets, particularly energy. You don’t want to miss this show. Here is the link to listen live or listen once the podcast is recorded:

https://callin.com/?link=ErBPMoCkzF

In order to listen live you must download the “Callin” app or you can listen to the recording on any computer or device after the show is complete.

Although I occasionally offer free newsletters like this one, most of the market analysis, macro-economic forecasting and land investment strategies are provided to paid subscribers only. For access to a paid membership at 35% off, click here to subscribe. Paid members are given access to my entire archive of past articles including the “hierarchy of financial needs”, “land investment strategies” and my framework for trading the markets.

**As Always, this article was not financial advice. For financial advice, please consult with a licensed financial advisor for your particular financial situation.**